The Best Travel card

The “best” choice for travel cards will depend on the user’s tastes, travel habits, and the particular advantages each card provides. I can, however, give you details on a few well-liked best travel cards that are generally thought to be fantastic options. Note that this is not a comprehensive list, and before choosing a card, carefully consider its features, terms, and conditions.

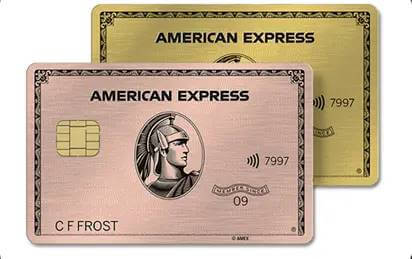

- American Express Platinum Card:

- Key features include extensive access to airport lounges, hotel elite status, travel credits, and TSA PreCheck/Global Entry charge credits.

- High annual fee ($695).

- Ideal for: Regular travelers looking for premium perks and unique experiences.

READ ALSO: Travel With Green Card

American Express Platinum Card

2. Chase Sapphire Reserve:

- Important characteristics: generous travel benefits, access to airport lounges, an annual travel credit, and a credit for Global Entry/TSA PreCheck fees.

- High annual fee ($550).

- Ideal for: Regular travelers who appreciate luxurious features and perks.

3. Citi Premier Card:

- Key characteristics include generous dining, entertainment, and travel rewards, the absence of foreign transaction fees, and flexible redemption possibilities.

- Cost per year: Moderate ($95).

- Ideal for: Visitors who spend a lot of money on lodging, food, and entertainment.

4. Capital One Venture Rewards:

- Key characteristics include flexible travel rewards, a quick redemption method, no foreign transaction fees, and a credit for the Global Entry/TSA PreCheck charge.

- Ideal for: Travelers who value simple use and flexibility when accumulating and using rewards.

- Cost per year: Moderate ($95).

READ ALSO: Visa Application Mistakes You Need to Avoid

5. Discover it Miles:

Key Benefits: No annual cost, flat points on all purchases, no international transaction fees, flexible redemption possibilities, and more.

Ideal for: Travelers on a tight budget searching for a basic travel card.

6. Bank of America Travel Rewards:

- Key characteristics include not having an annual fee, customizable incentives, not having to pay fees for international transactions, and relationship bonuses for Bank of America customers.

- No annual fee.

- Ideal for: Customers of Bank of America looking for a simple travel rewards card.

7. United Explorer Card:

- Key Features: United Club passes, priority boarding, free checked bags, airline-specific benefits, and more.

- Cost per year: Moderate ($95).

Ideal for: Regular passengers on United Airlines who want to make the most of their perks.

Remember to carefully review the terms and conditions, annual fees, interest rates, rewards structure, and additional benefits of each card to determine which one aligns best with your travel habits and financial goals.

SOURCE: Bisimaii.com